National & State Parks

Continue your child’s education as you explore the natural wonder of national and state parks in {{state}}.

What's Popular

Homeschoolers and Public Libraries: A Synergistic Relationship

Homeschoolers are commonly heavy users of their local libraries. Libraries can become educational hubs for homeschoolers by providing programming, information, and events. Homeschoolers can help libraries by advocating for libraries and urging lawmakers to support these vital institutions in their communities.

Homeschooling as a Widow or Widower

How do widows and widowers continue to fulfill the challenging roles of dad/mom, homeschooler, breadwinner, and sole disciplinarian, without losing focus of the total picture? Grace Hull provides a look at some approaches to coping with this difficult situation.

A Homeschool Curriculum for Preschool and Kindergarten

"Can anyone recommend a curriculum for pre-K and kindergarten? This is a frequent question homeschooling bulletin boards and email lists. It's a perfectly reasonable question, but some of the responses can be confusing to new homeschoolers. We all come into homeschooling with some common preconceptions of what the program should be - but many who have been at it for a while or raised homeschool grads are likely to strongly suggest not setting up a structured study program for young children. This is where some misunderstanding can come into play. Saying that a structured study program for a young child is inappropriate is not at all the same as saying that learning is unimportant during the early years. It's simply that many experienced homeschoolers and other educators feel there are certain kinds of activities that are much more important and appropriate in early childhood than studying the 3 R's - and that to establish a structure that emphasizes the 3 R's at that age can actually be detrimental. If a child is asking to learn to read, of course, that's a whole different matter - but it's simply a question of helping that child learn to read, which is very different thing from setting up a curriculum.

Large Family Logistics

This group offers a discussion of Kim Brenneman's book Large Family Logistics.

The Truth about Homeschooling and Socialization

The reality of homeschool socialization is that there are usually more opportunities to socialize than there is time. The crush of activities, friends, and interactions with others keeps most homeschoolers more than busy.

Math Work - Math Worksheet Generator

Make your own math worksheets with this math worksheet generator. Covers addition, subtraction, multiplication, division, and mixed skills.

It's Time for the PSAT/NMSQT

Although this article has some outdated date information in it, it is a good discussion of the use of the PSAT/NMSQT (Preliminary Scholastic Aptitude Test and National Merit Scholarship Qualifying Test) for homeschoolers, especially those who are interested in qualifying for certain scholarships.

HSLDA's Position on Tax Credits Generally

Although a credit or deduction could be helpful for homeschoolers, HSLDA opposes any tax break legislation that could come with governmental regulations. Homeschoolers have fought far too long and much too hard to throw off the chains of government regulation that hinder effective education and interfere with liberty. It would be inconsistent and foolhardy to accept tax incentives in exchange for government regulation. However, HSLDA supports tax credits that promote educational choice without threatening any regulation of homeschoolers. - See more at: http://nche.hslda.org/docs/nche/000010/200504150.asp#sthash.tvLv2ItR.dpuf

Preparing for Preschool Math

Preschoolers do math even though they are not sitting at desks with workbooks or memorizing multiplication tables. Preschool math helps them make sense of the world around them and teaches them to reason and problem-solve. Teachers of preschool math build on children's prior knowledge and capitalize on their spontaneous discoveries to further their understanding of mathematical concepts.

Department of Defense Education Activity Home Schooling Policy Memorandum

It is the policy of the DoDEA to neither encourage nor discourage DoD sponsors from home schooling their minor dependents. DoDEA recognizes that home schooling is a sponsor's right and can be a legitimate alternative form of education for the sponsor's dependents. Contains the entire text of the memo, dated November 6, 2002.

Resources

-

National Geographic Complete National Parks of the United States, 3rd Edition: 4...

-

National Geographic Atlas of the National Parks

-

100 Parks, 5,000 Ideas: Where to Go, When to Go, What to See, What to Do

-

USA National Parks: Lands of Wonder

-

National Geographic Guide to National Parks of the United States 9th Edition

-

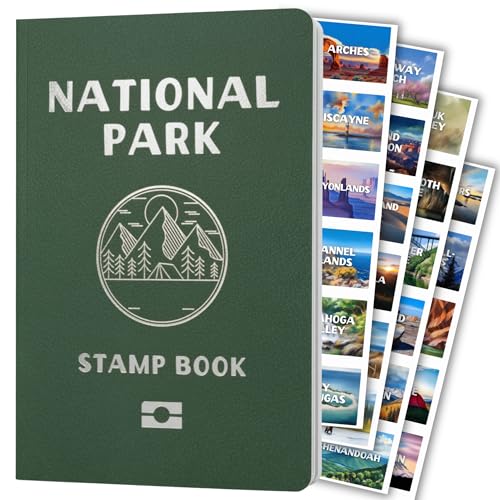

National Parks Stamp Book with Sticker Set: Passport-Sized National Park Book wi...

-

Subpar Parks: America's Most Extraordinary National Parks and Their Least I...

-

Mysteries of the National Parks: 35 Stories of Baffling Disappearances, Unexplai...

Featured Resources

-

National Geographic Guide to State Parks of the United States, 5th Edition

-

50 States 500 State Parks

-

National Geographic Complete National Parks of the United States, 3rd Edition: 4...

-

National Geographic Ultimate Guide to the National Parks: A Complete Tour of All...

-

National Geographic Guide to National Parks of the United States 9th Edition

-

Guide to State Parks